CME Group Trade Against a Pro Trading Challenge

Hashtags: #cmegroup #cme #trading #markets

March 3rd - 8th 2019

First of all, I will get straight to the dirt. March 3rd Sunday evening to March 8th Friday afternoon...there was a futures trading competition. This was my first futures trading competition and I only entered the competition after persistent requests by three other Advance WRB Analysis Tutorial Chapters 4 - 12 clients that I've grown to trust the past 5 years...two I've personally have met and consider them to be personal friends.

My competition user name was Matoskah Akecheta...Indigenous American spiritual name given to me by my father and grandmother...both are Lakota, Sioux.

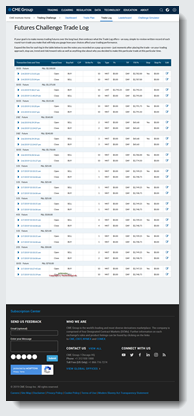

My competition user name was Matoskah Akecheta...Indigenous American spiritual name given to me by my father and grandmother...both are Lakota, Sioux.(make sure you scroll all the way to the right in the image to view the Total P&L)

Matoskah Akecheta (wrbtrader) CME Group Futures Trading Challenge Final Result @ https://www.forum-tsl.thestrategylab.com/download/file.php?mode=view&id=94

Matoskah Akecheta (wrbtrader) CME Group Futures Trading Challenge Final Result @ https://www.forum-tsl.thestrategylab.com/download/file.php?mode=view&id=94 Matoskah Akecheta (wrbtrader) CME Group Futures Trading Challenge Final Ranking 144th (top 10%) of 1680 competing traders @ https://www.forum-tsl.thestrategylab.com/download/file.php?mode=view&id=93

Matoskah Akecheta (wrbtrader) CME Group Futures Trading Challenge Final Ranking 144th (top 10%) of 1680 competing traders @ https://www.forum-tsl.thestrategylab.com/download/file.php?mode=view&id=93 All of my trades in the CME Group trading competition were profitable !!!

All of my trades in the CME Group trading competition were profitable !!!  Matoskah Akecheta (wrbtrader) CME Group Futures Trading Challenge Final Trade Log @ https://www.forum-tsl.thestrategylab.com/download/file.php?mode=view&id=95 (verification image of profitable trades / every trade / no losing trades)

Matoskah Akecheta (wrbtrader) CME Group Futures Trading Challenge Final Trade Log @ https://www.forum-tsl.thestrategylab.com/download/file.php?mode=view&id=95 (verification image of profitable trades / every trade / no losing trades)Final profits: $13,537.50 and no trades on the last trading day as shown in the Daily P&L while only trading 2 1/2 days of the 5 trading day competition. Every trade correlated with the WRB Analysis Free Study Guide, Advance Tutorial Chapter 4 education content with trade signals from the Volatility Trading Report (VTR) trade signal strategies.

The days I traded during the 5-day trading challenge...those days of trading represent how I normally traded. Unfortunately, I did not trade the first day (the biggest profitable trading day for most on the leaderboard). In addition, I then missed most of the another trading due to personal family reasons...resulting in trading only a few hours on each of those two trading days.

Also, I missed the final trading day of the trading competition...it was the most volatile trading day of the trading competition that would have placed me on the "leaderboard". Those missed trading days were the most volatile trading days with big directional price movements that I could have exploited for big profits. Regardless, the missed trading days are typical for me because I do not typically trade 5 trading days per week due to holidays, traveling, or days off to spend time with my family,

Regardless, historically in my own real-money trading, my biggest profits are during volatile trading days because my trade performance involves part science (WRB Analysis), part psychology, part art...especially when there are big WRB Hidden Gap intervals greater than the average from Key Market Events.

With that said, the CME Group marketed the competition as "trade against a Pro" trader named Mr. Bobby Iaccino of Path Trading Partners...a professional trader. I first heard about Mr. Iaccino back in 2002 from a close family friend who lives in Chicago. Also, I've seen Mr. Iaccino on many different financial news networks: CNBC, CNBC Asia, Bloomberg Television and Radio, CNN, CNN International, CNN Moneyline, Fox Business News, First Business (Canada), and Phoenix TV (China).

Further, with the persistent requests by clients of the Advance WRB Analysis Tutorial Chapters and my curiosity about Bobby Iaccino along with the fact I will be trading against other traders (their trade methods) from around the world...WRB Analysis against other trade methods...I just had to participate in the trading competition even though I knew the timing for me was very bad (explained lower).

Ok, I'll get into the trade results of Bobby Iaccino considering the CME Group used him as bait on a hook to lure in other traders (mostly retail) into the competition. Bobby Iaccino is successful trader but finish in the competition with a ranking of 490...trading Crude Oil CL futures and Nasdaq Emini NQ futures...losing -$3398.75 but at one point...it seem like he had one particular day of no trades on the same day that I had no trades. Most likely he had other business obligations that prevented him from trading one of the days in the trading competition because he was in the red (losses) for awhile without gaining/losing another penny.

I will now discuss my final trading ranking...a 144th out of 1680 traders...profits of $13537.50 via 14 trades. The other three known Advance WRB Analysis Tutorial Chapters users and I finish in the top 10%. The other three traders performance was much better than mine but only because they traded every day of the trading competition whereas I only traded 2 1/2 days.

As stated above, I did not trade the first day (the biggest profitable trading day for most on the leaderboard), the 1/2 day I missed was another big price movement trading day and I didn't trade the last day of the competition due to personal reasons involving my kids spring break...they were on a vacation from school. In fact, the best ranking I reached was 94th but dropped down to 144th on the last trading day because of "no trades" while I concentrated on my real money trades that had priority over a simulation trading competition. Simply, I missed the last trading day in the competition even though it was just a 1/2 trading session.

I did not enter the competition to compete against Mr. Bob Iaccino. I entered the competition to compete against the other three Advance WRB Analysis Tutorial Chapters 4 - 12 clients and to have WRB Analysis compete against other trade methods used by retail/professional traders in the competition as an additional measurement about the merits of WRB Analysis. Too bad the CME Group didn't make it a requirement in the registration that the traders had to disclose the name of their trade method...viewable by anyone that's registered so that they can compare the performance of their trade method against the trade method of others beyond the trader against trader. Traders would have seen 4 traders using the Advance WRB Analysis Tutorial Chapters...ranked in the top 10% (top 168) traders out of 1680 competitors if the CME Group had allowed traders to provide a name of their trade methodology including two in the top 10% using the Volatility Trading Report (VTR).

----------------

One of the Advance WRB Analysis Tutorial Chapters users made it onto the top 9 leaderboard...very impressive. As for myself, I did not have a losing trade via the Volatility Trading Report (VTR) trade signal strategies that are merged with the WRB Analysis Free Study Guide or the Advance WRB Analysis Tutorial Chapters.

Yet, I was outperformed by the other users of the Advance WRB Analysis Tutorial Chapters and overall good trading performance by members of TheStrategyLab that competed in the trading competition.

----------------

I'll repeat the above sentence just in case you missed it. A trader of the Advance WRB Analysis Tutorial Chapters 4 - 12 made it on the "leaderboard" of the final results. As for my trade performance (rank 144th)...not as good as the performance of other Advance WRB Analysis users...all of my trades were profitable in the trade competition. Yet, I will disclose that I did have two very problematic trades that would have resulted in losing trades had I used my normal trade management and I didn't trade both the daytime trading session and the nighttime trading session.

Further, the other 3 traders who used the Advance WRB Analysis Tutorial Chapters 4 - 12 had an average win rate of 75% with larger profits than mine while trading the same position size although we didn't trade the same trading instruments. I only traded Emini ES futures and Brent Oil BZ futures....the latter only because I saw a few on the leaderboard also trading Brent Oil BZ futures along with the fact the Oil futures are part of my key market inter/intramarket analysis. Yet, the next trading day they were no longer on the leaderboard but overall they had a better final ranking result than me.

I started late on the first day of competition and by the time I made my first trade...the top 9 traders on the leaderboard were already in the profit by +20k to 40k...they caught most of the big price movement on the first day of the trading competition and many on the leaderboard the first day of the competition...they remained on the leaderboard because of their big profits from that first day of the trading competition. Further, the tournament begins Sunday evening and I notice the profits increasing on the leaderboard in the overnight trading session. These were either hard-core simulator traders or traders in Europe...while it was night here in North America (I was asleep).

I'm not going to reveal the identities of the other Advance WRB Analysis clients but I did post above my tournament trading generic stats although I wished the CME Group would have posted traditional trading statistics of the traders' performance for those into the quantitative data for review. As stated, the user name I used in the competition was Matoskah Akecheta...my Native American Indian name (nickname) given to me by my father and grandmother (Lakota, Sioux).

Disadvantages for me in the Competition:

I didn't trade every day of the simulation trading account in comparison to many on the leaderboard who did trade every day of the trading competition.

In addition, I was trying to trade my real money trading account during the times I traded in the CME Group simulation trading competition. Trying to use two completely different broker trade execution platforms was extremely mind-tasking for me. Also, the double screen confirmation in the CME Group simulation platform is poorly set up...it cost me about 4 points in my biggest winner because I didn't know it had a double confirmation screen. Thus, when I executed the trade in the first confirmation...I went back to my other trade execution platform to monitor a real money trade that was having problems...not knowing the trade at the CME Group website had not been executed...there was a 2nd screen that popped up that needed me to just click the OK button to execute the trade.

Also, I didn't trade the overnight trading session while others on the leaderboard did trade in the overnight trading session. In fact, it was the overnight trading session where they made the most profits.

Finally, I scheduled spring break activities with the kids during this time of the year. Thus, lots of family distractions. I concluded on the 2nd day of the competition that my real money profits would exceed the prize awards of those top 3 traders in the CME Group Simulation Competition.

Advantages for me in the Competition:

I'm a profitable real money trader and I used my broker platform charts to help a little in the CME Group Trading Competition because the charts at the CME were not suitable for my inter/intra market analysis chart configurations.

More importantly, I was only competing against the other three Advance WRB Analysis clients in the competition and competing against the trade methods of the other 1680 competitors in the competition. The goals I had were 1) a high percentage of profitable trades 2) a final ranking in the top 10%. I achieved my goals although the timing of the tournament was not ideal for me (kids were on spring break...I had already planned vacation activities with them) but I managed well everything that was going on during the week of the trading competition.

Real money trades in my trading, simulation trades in the trading competition, and the kids' spring break vacation. That was a big confidence booster for me because I have been struggling with multi-tasks since my illness/hospitalization in the fall of 2016.

The trade execution platform by the CME Group was web-based...a step down from my real money broker trade execution platform. Simply, I adjusted fast to the broker platform used by the CME Group for the trading competition.

Twitter @ https://twitter.com/cmegroup

Twitter @ https://twitter.com/cmegroup  Hashtags: #cme #cmegroup #trading #futures #commodities

Hashtags: #cme #cmegroup #trading #futures #commodities  CME Group Website @ https://www.cmegroup.com/

CME Group Website @ https://www.cmegroup.com/  Wikipedia @ https://en.wikipedia.org/wiki/CME_Group

Wikipedia @ https://en.wikipedia.org/wiki/CME_Group  linkedin @ https://www.linkedin.com/company/cme-group

linkedin @ https://www.linkedin.com/company/cme-group  Youtube @ https://www.youtube.com/user/cmegroup

Youtube @ https://www.youtube.com/user/cmegroup  Facebook @ https://www.facebook.com/CMEGroup/

Facebook @ https://www.facebook.com/CMEGroup/  Reuters @ https://www.reuters.com/companies/CME.O

Reuters @ https://www.reuters.com/companies/CME.O-----------------

Price Action Trading @ https://www.thestrategylab.com/price-action-trading.htm

Price Action Trading @ https://www.thestrategylab.com/price-action-trading.htm  Trade Strategies via Volatility Analysis @ https://www.thestrategylab.com/VolatilityTrading.htm

Trade Strategies via Volatility Analysis @ https://www.thestrategylab.com/VolatilityTrading.htm Rebuttal to Emmett Moore via TheStrategyLab.com Review @ https://www.thestrategylab.com/tsl/forum/viewtopic.php?f=84&t=3167

Rebuttal to Emmett Moore via TheStrategyLab.com Review @ https://www.thestrategylab.com/tsl/forum/viewtopic.php?f=84&t=3167  Review of Emmett Moore Jr. Tradingschools @ https://www.thestrategylab.com/emmett-moore-jr-tradingschools-review.htm

Review of Emmett Moore Jr. Tradingschools @ https://www.thestrategylab.com/emmett-moore-jr-tradingschools-review.htm  Where did wrbtrader go? | Elite Trader @ https://www.thestrategylab.com/tsl/forum/viewtopic.php?f=307&t=3770

Where did wrbtrader go? | Elite Trader @ https://www.thestrategylab.com/tsl/forum/viewtopic.php?f=307&t=3770 The Strategy Lab: Valforex - The Manipulative Review Scam @ https://www.thestrategylab.com/tsl/forum/viewtopic.php?f=84&t=3676

The Strategy Lab: Valforex - The Manipulative Review Scam @ https://www.thestrategylab.com/tsl/forum/viewtopic.php?f=84&t=3676 TheStrategyLab Review @ https://www.thestrategylab.com/thestrategylab-reviews.htm

TheStrategyLab Review @ https://www.thestrategylab.com/thestrategylab-reviews.htm  Advance WRB Analysis Tutorial Chapters 4 - 12 @ https://www.thestrategylab.com/WRBAnalysisTutorials.htm

Advance WRB Analysis Tutorial Chapters 4 - 12 @ https://www.thestrategylab.com/WRBAnalysisTutorials.htmTheStrategyLab / M.A. Perry

wrbtrader / Price Action Trading

Trader and Founder of WRB Analysis (wide range body/wide range bar analysis)

a.k.a. wrbtrader (more info about me): https://www.thestrategylab.com/tsl/forum/viewtopic.php?f=127&t=850 & https://www.thestrategylab.com/wrbtrader.htm

@ https://twitter.com/wrbtrader

@ https://twitter.com/wrbtrader  @ https://stocktwits.com/wrbtrader

@ https://stocktwits.com/wrbtrader  @ https://www.tradingview.com/u/wrbtrader

@ https://www.tradingview.com/u/wrbtrader  @ https://www.twitch.tv/wrbtrader/

@ https://www.twitch.tv/wrbtrader/Youtube @ https://www.youtube.com/user/wrbtrader/

Flickr @ https://www.flickr.com/photos/42832721@N08/

Pinterest @ https://www.pinterest.ca/thestrategylab/

Imgur @ https://imgur.com/user/thestrategylab

TheStrategyLab @ https://www.thestrategylab.com/

Phone: +1 224 307-4434

Business Hours: 8am - 5pm est (Mon - Fri)

Skype Messenger: kebec2002 (24/7)

wrbanalysis@gmail.com